You can no longer contribute to an HSA once you're enrolled in Medicare.Ĭoming up with accurate eligibility status for the list of HSA eligible expenses can be a challenge at times.

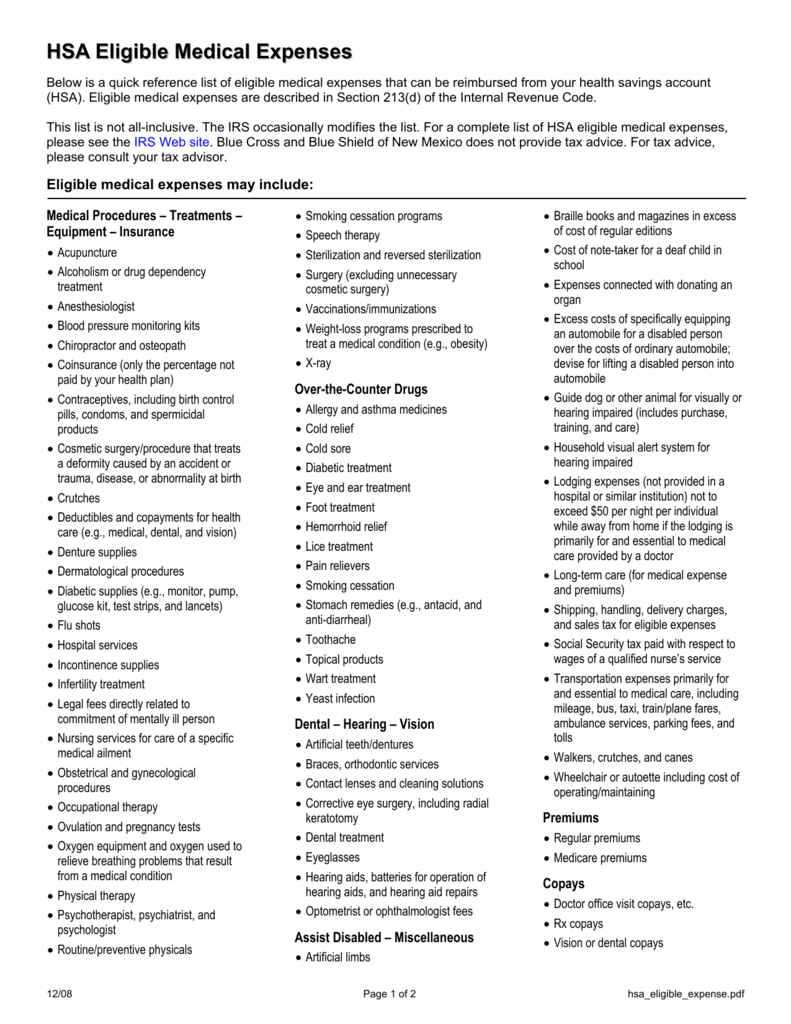

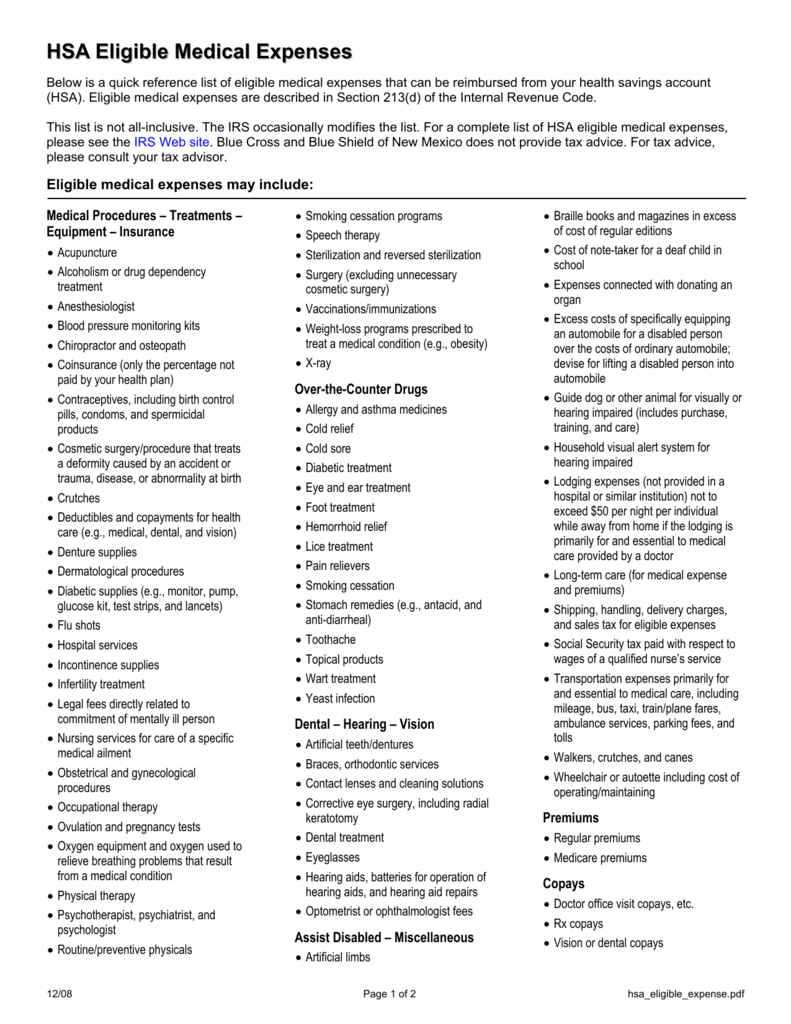

Funds can be withdrawn at any time for any reason, but funds withdrawn for non-approved medical expenses before the age of 65 are subject to income taxes and an additional penalty. That is, funds are contributed pre-tax, can be withdrawn for eligible medical expenses without taxation, and if you invest the funds within your HSA the earnings or interest are tax free. Funds in a health savings account can be invested in a similar way as other retirement accounts and are a rare example of an account that's triple tax advantaged. You can find current and historical HSA contribution limits on this site. Contributions to an HSA can be made by an employer and/or employee on a pre-tax basis. This list includes products like allergy medication, pain relievers, prenatal vitamins, and tampons. As part of the 2020 CARES Act, over-the-counter medications and menstrual care products are now eligible for purchase with health savings accounts (HSAs), flexible spending accounts (FSAs), and health reimbursement arrangements (HRAs).

Funds can be withdrawn at any time for any reason, but funds withdrawn for non-approved medical expenses before the age of 65 are subject to income taxes and an additional penalty. That is, funds are contributed pre-tax, can be withdrawn for eligible medical expenses without taxation, and if you invest the funds within your HSA the earnings or interest are tax free. Funds in a health savings account can be invested in a similar way as other retirement accounts and are a rare example of an account that's triple tax advantaged. You can find current and historical HSA contribution limits on this site. Contributions to an HSA can be made by an employer and/or employee on a pre-tax basis. This list includes products like allergy medication, pain relievers, prenatal vitamins, and tampons. As part of the 2020 CARES Act, over-the-counter medications and menstrual care products are now eligible for purchase with health savings accounts (HSAs), flexible spending accounts (FSAs), and health reimbursement arrangements (HRAs).  HSAs are only available as part of a high-deductible health insurance plan (HDHP). The MMA was the largest overhaul to Medicare in the program's history.

HSAs are only available as part of a high-deductible health insurance plan (HDHP). The MMA was the largest overhaul to Medicare in the program's history.

Health savings accounts (HSAs) were created as part of the Medicare Prescription Drug, Improvement, and Modernization Act, or MMA, signed into law by President George W.

0 kommentar(er)

0 kommentar(er)